Simple four-step process

1. Select your business and submit a self-service order.

2. We will receive the documents via email, review them by experts and upload them to the government database.

3. After reviewing and verifying the accuracy of the document, we will submit it immediately.

4. Once your application is submitted, you will receive all approval documents via email. —Please make sure to submit your email address when placing your order!

GST/HST tax rebate for newly purchased house to live in or rent out

What are tax rebates (GST/HST Rebates) for new homes purchased for self-occupation or rental?

There are two types of GST/HST rebates for newly purchased houses.

One is the rental house rebates (GST/HST New Housing Rebates, referred to as NHR).

The other is the self-occupied housing tax rebate (GST/HST New Residential Rental Property Rebates, referred to as NRRPR). Rebate Application for Owner-Built Houses, referred to as NHRAOBH).

Learn more

Tax rebate for self-occupation

-

Underused Housing Tax (UHT)

regular price $100.00 CADregular priceunit price unit price -

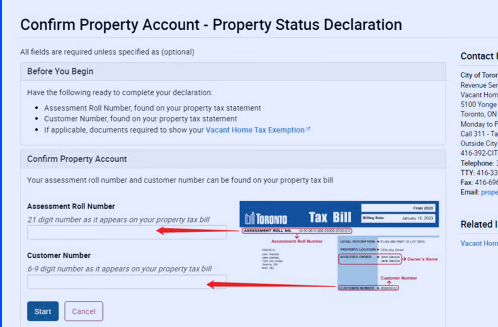

Toronto Vacant Home Tax

regular price $50.00 CADregular priceunit price unit price -

Tax Clearance Certificate for Non-Resident Canadian Property Sale

regular price $300.00 CADregular priceunit price unit price -

UHT declaration for Canadian companies

regular price $100.00 CADregular priceunit price unit price -

Non-Resident Canadian Property Sales Tax Rebate

regular price from $300.00 CADregular priceunit price unit price -

NRST tax refund

regular price $1,200.00 CADregular priceunit price unit price -

New Home Owner-occupied Tax Rebate (NRRRPR)

regular price $400.00 CADregular priceunit price unit price -

Home Renovation Refund (NRRRPR)

regular price $1,000.00 CADregular priceunit price unit price

Rental tax rebate

-

Underused Housing Tax (UHT)

regular price $100.00 CADregular priceunit price unit price -

Non-Resident Rental Income Withholding Tax Payment Arrangement

regular price $40.00 CADregular priceunit price unit price$100.00 CADSale price $40.00 CADdiscount price -

Declaration of rental income from Canadian property for non-residents

regular price $300.00 CADregular priceunit price unit price$300.00 CADSale price $300.00 CAD -

Declaration of rental income from Canadian property for non-residents

regular price $400.00 CADregular priceunit price unit price$400.00 CADSale price $400.00 CAD

Customer testimonials

Golden Key helped me integrate my business in a simple and direct way. Christina provided me with a lot of help and answered all the questions I had during the process. I highly recommend Golden Key to all startups!