| City |

Tax Rate |

Applicable Situations |

Notes / Impact |

| City of Toronto |

3% of the property’s assessed value starting in 2024. (1% in 2022–2023) |

Applies to residential properties within city limits that were vacant for ≥ 6 months (183 days) in the previous calendar year and do not meet exemption criteria. |

Toronto faces tight housing supply with an estimated vacancy rate of 1–1.2%. The rate increase to 3% aims to further encourage owners to occupy, rent, or sell their properties. |

| City of Ottawa |

Base rate: 1% of assessed value. Starting in 2025, properties vacant for multiple consecutive years will face a 1% annual increase, up to a maximum of 5%. |

Applies to residential properties (classified under the residential tax category) that were vacant for over 184 days and are not principal residences or exempt. |

Designed to encourage owners to return vacant homes to the market and increase housing supply. In 2023, approximately 3,672 units were identified as vacant. |

| City of Hamilton |

1% of the property’s assessed value. |

Applies to residential units vacant for more than 183 days in the previous calendar year without an exemption. |

Officially effective in 2025 (based on 2024 property status). The program aims to boost housing utilization and reduce long-term vacancies. |

| City of Windsor |

3% of the property’s assessed value. |

Applies to residential properties vacant for more than 183 days in the previous year without exemption. |

A newer program launched in 2024, intended to increase housing availability and reduce the negative impact of vacant homes. |

| City of Sault Ste. Marie |

Proposed rate: 4% of the property’s assessed value. |

Applies to residential properties vacant for more than 183 days in the previous calendar year and not meeting exemption criteria. |

Set to take effect in 2025 (based on 2024 status). The relatively higher rate reflects the city’s intent to strongly discourage long-term vacancies. |

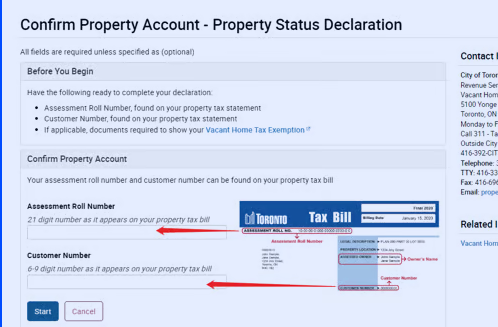

Who is eligible?

All property owners in the relevant area are required to file a vacancy declaration, regardless of their place of origin or tax residency status.

How is it calculated?

A vacancy tax of 1%-4% of the current assessed value (CVA) will be levied on all Toronto residential properties declared, identified, or determined to be vacant for more than six months in the previous year.

For example, if your property's CVA is $1 million CAD, the tax will be $10,000 CAD ($1% x $1,000,000 CAD).

The tax is based on the property's occupancy status in the previous year. For example, if a property was vacant in 2023, the tax will begin to be paid in 2024.

What happens if I don't file?

If the owner fails to file an annual return and/or provide supporting documentation by the deadline, the residential property will be considered vacant and subject to a mandatory vacancy tax. Additional penalties may also apply for non-compliance.

Unsure if your property qualifies?

Check the municipal icons in the image. If the corresponding icon appears on your property tax bill, you need to file a return!

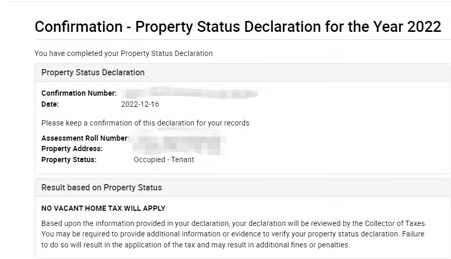

If your declaration contains errors, you can:

Submit a new declaration before the April 30th filing deadline;

If it is after the filing deadline, file a complaint notice;

Failure to file or making a false declaration may result in a penalty of $250 to $10,000 CAD.