常见问题

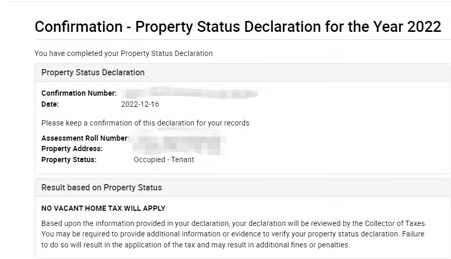

1. Q: What is Toronto’s Vacant Home Tax (VHT)? Do I need to declare?

A: VHT is a municipal tax on residential properties vacant for >6 months/year. All homeowners MUST declare annually (even if exempt). Failure to declare incurs penalties!

2. Q: My property is rented/owner-occupied. Why use your service?

A: Critical! Exemptions require documented proof (e.g., lease, utility bills). We ensure compliance to avoid misclassification as vacant, saving you hours of government follow-ups.

3. Q: What if I miss the declaration deadline?

A: Late filings are automatically taxed as VACANT (1% of CVA) + penalties. Use our urgent late-filing service to reduce fines and correct status.